New figures: Dollar will lose 10 percent of its value due to BRICS countries' de-dollarisation. Chain reaction looms

KARSTEN MONTAG, 9. Juni 2023, 0 Kommentare, PDFNote: This article ist also available in German.

The plans of the BRICS countries to break away from the global financial dominance of the US go back several years and initially began with the founding of a bank. In 2014, the New Development Bank was created as an alternative to the World Bank and IMF to support public or private projects through loans, guarantees, equity participation and other financial instruments. The founding members Brazil, Russia, India, China and South Africa own equal shares of the bank. In 2021, the United Arab Emirates, Bangladesh, Uruguay and Egypt were admitted as junior partners. Accession talks are currently being held with Saudi Arabia.

World-wide shift away from the dollar

The global shift away from the dollar, which has been gaining decisive momentum since the war in Ukraine in 2022, also has a history of several years. Since 2016 at the latest, consultations have been taking place between Beijing and Riyadh to settle at least part of Saudi Arabia's oil deliveries to China in the Chinese currency, the yuan. These talks intensified in 2022. Chinese President Xi Jinping encouraged the Arab states to accept the settlement of oil deliveries to China in yuan.

In March 2023, Russia's President Vladimir Putin announced his intention to settle all oil and gas transactions with China in yuan in the future. In May, it also became known that Pakistan will most probably acquire Russian oil in exchange for yuan. In addition, Russia and Iran are currently planning to introduce a common gold-backed cryptocurrency to replace the dollar in their trade transactions.

In the 2022 election campaign for the Brazilian presidency, Lula da Silva had proposed a new common currency for Latin America called the "Sur" (Spanish for "South"). After his re-election as president, he and Argentine President Alberto Fernandez announced in January 2023 that Brazil and Argentina would move forward with talks on a common South American currency. Other South American countries would be invited to join the project to replace the dollar as the exchange currency in Latin America.

On the sidelines of the World Economic Forum in Davos in January 2023, Thani Al Zeyoudi, Minister of Foreign Trade of the United Arab Emirates, said his country was in talks with India to settle cross-border trade in rupees. The oil trade is not supposed to be affected by this.

Finally, at an event at St. Petersburg International Economic Forum in New Delhi at the end of March 2023, the Vice Chairman of the Russian State Duma Alexander Babakov revealed that the BRICS countries were working on the development of a new currency to be presented at the upcoming BRICS summit in South Africa in August. The transition to settlements in national currencies is the first step. The next is to allow the circulation of digital or other forms of a fundamentally new currency in the near future. This currency will be pegged, according to Babakov, to gold and other raw materials such as rare earths.

Almost at the same time, Brazil and China signed an agreement on trade in mutual currencies, the real and the yuan, instead of using the dollar. During a state visit to China in April, Brazil's President Lula found strong words:

"Why should every country have to be tied to the dollar for trade?... Who decided the dollar would be the (world's) currency?... Why can't a bank like the BRICS bank have a currency to finance trade between Brazil and China, between Brazil and other BRICS countries?... Today, countries have to chase after dollars to export, when they could be exporting in their own currencies."

Is the postulation of the end of the dollar hegemony an overstatement?

In view of these developments, some media are speculating on a possible end of dollar hegemony. The magazine "Responsible Statecraft" stated in May under the headline "De-dollarisation: Not a question of if, but when" that the sudden decline in dollar demand could trigger a dollar crisis "leading to very high inflation, or even hyperinflation, and initiate a debt and money printing cycle that could tear apart the social fabric of society". However, the thesis was not backed up by figures.

An article on the website of the US investment bank Morgan Stanley, also from May, states quite the opposite: "While the dollar’s pre-eminent role in global trade and finance could diminish with time, recent fears about its demise seem overblown." There are indeed some figures in this text, for example on the share of the dollar, euro and yuan in payments in global trade, as well as in foreign exchange reserves. But the latter are, among other assets, funds held by central banks in foreign currencies for foreign exchange market interventions and to finance foreign trade deficits. And the share of the dollar in global trade does not give any clue about how many dollars are circulating outside the United States. Therefore, it is hard to draw conclusions about what impact the use of alternative currencies would have on the value of the dollar. For this, the bilateral trade volume of those states that turn their backs on the dollar is needed - as well as the actual amount of US dollars outside the US.

Determining the basic figures

In this article, the share of the trade volume of various economic regions - BRICS, BRICS plus candidate countries, plus South America, plus Asia - in the total volume of global exchange of goods and services is determined by using current bilateral trade data. In a second step, different approaches are used to estimate the amount of US dollars circulating outside the US - a figure for which no official data is available. There will also be a closer look at how US dollars enter international circulation in the first place and what the "exorbitant privilege" of providing the world's reserve currency means for the United States.

On the basis of these figures and with the help of forecasts for global trade, it is possible to calculate what effects a shift away from the dollar in the various economic areas would have on its value - and thus also on the coverage of the US foreign trade balance and on the financing of the US national budget.

Global trade volume and the importance of the dollar

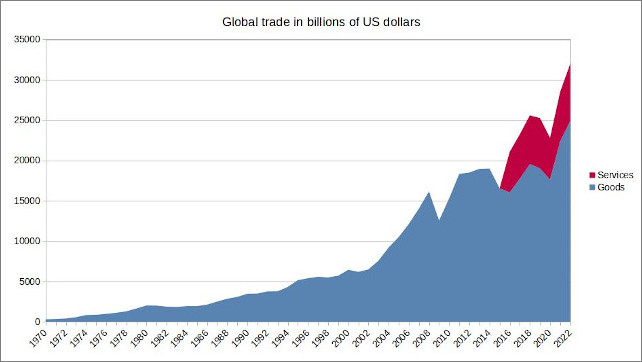

Global trade in goods and services has grown enormously over the last 50 years. While the volume of trade in the mid-1970s was still one trillion dollars, it has risen to a total of 32 trillion in 2022. 25 trillion is accounted for by the exchange of goods, seven trillion for trade in services.

Figure 1: Global trade in billions of US dollars, data source: World Trade Organisation

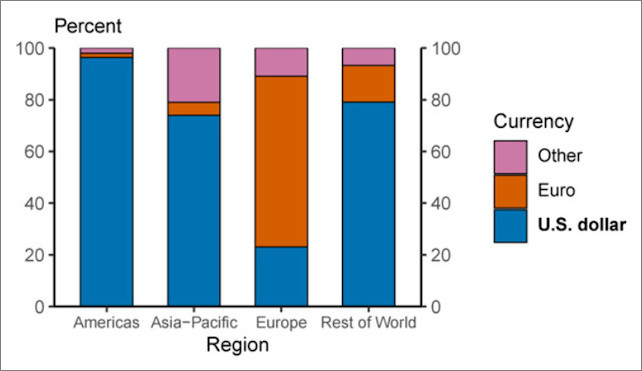

There are various approaches to estimating the importance of the dollar in global trade. For example, the dollar's share of total currency reserves over the last 20 years was around 60 per cent, while the euro's share was around 20 per cent. In addition, the dollar accounted for about 88 percent of all transactions on the foreign exchange market over the last 20 years. This information is summarised in a document of the US central bank, Federal Reserve (Fed). The following figure is also taken from this document.

Figure 2: Share of currencies in export settlement by region from 1999 to 2019, where data were available, Image source: Federal Reserve

The US dollar therefore has a high to very high share in the settlement of global trade, except in Europe and depending on the region. Before introducing the euro, European currencies such as the D-Mark, the French franc and the Dutch guilder already had a relatively high share of exchange currencies, especially in Europe, as well as of currency reserves. To simplify the calculations, the following assumes a share of the US dollar in the money supply in circulation worldwide for the settlement of global trade, excluding Europe, of 80 per cent.

In order to calculate the share of the trade volume of the BRICS countries, the Latin American, Asian and African countries among each other in relation to the volume of global trade, the bilateral trade data of these countries are needed. This data can be found on the website of the United Nations Conference on Trade and Development (UNCTAD), a permanent body of the UN General Assembly.

Various scenarios of de-dollarisation

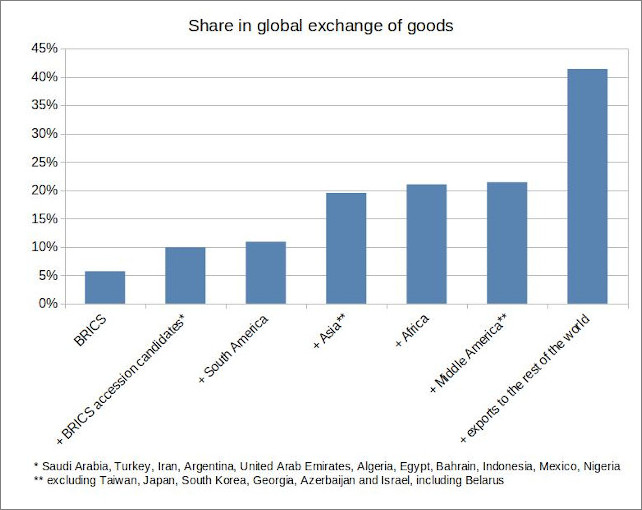

From Figure 1 it can be derived that in 2021, the global exchange of goods was worth $22.3 trillion. The trade volume of the BRICS countries among each other amounted to 1.3 trillion dollars, which corresponds to a share of six per cent.

Figure 3: Share in global exchange of goods, data source: UNCTAD

If the BRICS accession candidates Saudi Arabia, Iran, Argentina, Mexico, the United Arab Emirates, Algeria, Egypt, Nigeria, Bahrain, Indonesia and Turkey are added, their total trade volume including BRICS countries amounts to ten per cent of global exchange, including all South American states, to eleven per cent.

If all Asian states - except for classic allies of the US and Europe such as Japan, South Korea, Taiwan, Georgia and Azerbaijan - are added, trade between these countries crosses the 20 per cent mark. If all these countries were to additionally stop exporting their goods to the rest of the world in exchange for dollars, their share of global trade would be 41 percent.

A similar picture emerges for global trade in services. Based on UNCTAD data, exports of services from North America, Europe, Oceania and their closest allies such as Japan, South Korea and Taiwan account for 70 percent of global trade in services in 2021.

The share of trade of the BRICS countries and their possible accession candidates in global trade may seem rather small at first glance. But as will be shown below, small causes can have large effects.

In order to assess the extent to which a shift away from the dollar in global trade could affect its value and what consequences this loss in value would then have for the US, the amount of dollars circulating outside the US needs to be determined. This is less trivial than one might suspect. Even the Fed, the only institution that is officially allowed to create US dollars, does not publish how many dollars are circulating outside the United States. In 2006, on the dubious grounds that this money supply, called the "Eurodollar", would no longer play a role in the monetary policy process, the Fed stopped publishing it.

What are Eurodollars?

US dollars showed up in the accounts of banks outside the United States after the Second World War for various reasons. The Marshall Plan, which was intended to promote the reconstruction of European states, was financed with dollars. European countries that exported their products to the US received dollars in return. And the Soviet Union withdrew its currency reserves from the United States and moved them to accounts in European banks in order to pre-empt possible sanctions by the US, for example because of the Korean War or the Russian invasion of Hungary after the revolution there in 1956. Since the first large amounts of US dollars outside the USA accumulated primarily in the accounts of European banks, the term "Eurodollar" was coined. Today, the term refers to all US dollars held in banks outside the United States.

Since the Eurodollar market is largely unregulated and not subject to any state institution, it is linked to "offshore banks" or the "shadow banking system". Since offshore banks are subject to less regulation and transparency requirements, they are used to hiding untaxed income from the revenue service. Shadow banks are even more non-transparent. These are financial companies such as hedge funds and insurance companies that offer similar financial services as commercial banks, but are not supervised by government banking regulations. Offshore and shadow banks are mainly found in offshore financial centres such as Luxembourg, Switzerland, Liechtenstein, Andorra, Monaco, Hong Kong, Singapore, Panama, the Bahamas or the Cayman Islands. In these places, additional US dollars are created by financial products and loans.

Eurodollar and the US foreign trade deficit - an exorbitant privilege

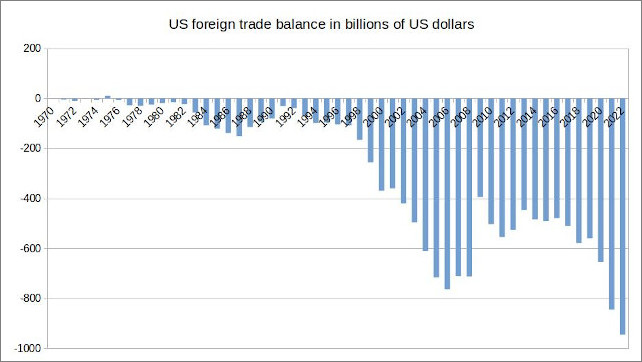

Tax evasion is one way US dollars enter the Eurodollar market. However, US imports are by far the largest source. American companies and consumers buy products abroad and pay for them in US dollars. However, since the United States has been running a steadily increasing annual trade deficit since the mid-1970s, a large portion of these US dollars does not return to the US.

Figure 4: US foreign trade balance in billions of US dollars, data source: World Bank

In 2022, the US foreign trade deficit has peaked at a record high of almost one trillion dollars. Since the dollars drained from the US are needed to finance the ever-growing global trade, this creates an "exorbitant privilege" for the US. The US central bank, the Fed, is literally forced to create new dollars because the money that has gone abroad is no longer available at home.

This ongoing process increases US debt, because money creation is always linked to the lowering of the base rate and money lending or the purchase of government bonds. But as long as global trade continues to grow and the US dollar continues to be used as the reserve currency for its settlement, the US need not fear bankruptcy. Because, in the end, growing global trade covers the debts of the United States. Where other countries would have long been over-indebted and bankrupt due to a decades-long foreign trade deficit, because they lack the foreign currency to buy oil, gas or other products abroad, the US can simply create the missing money supply anew. In this way, the people outside the US indirectly finance American prosperity, the subsidies of American companies and the US military - whose striking force is the ultimate guarantor of keeping this financial system up.

Estimating the volume of the Eurodollar

When the Fed stopped publishing the Eurodollar quantity in 2006, it estimated its amount at just under 430 billion US dollars. The US foreign trade deficit proves that this figure is probably too small by a factor of ten. Adding up the annual deficits of the United States, almost five trillion US dollars left the country between 1970 and 2005. By the end of 2022, this figure has risen to over 15 trillion. Various estimates show that these volumes are realistic and still even too low. In 1985, the Eurodollar market was estimated to have a net size of 1.7, and in 2016, 13.8 trillion dollars.

Another indication that the current volume of Eurodollars is more likely to be larger than 15 trillion is the ratio between the money supply M1 - i.e. cash plus the amount of demand deposits, travelers checks and other checkable deposits plus most savings accounts - and the gross domestic product (GDP). In 2022, the money supply M1 in the USA was 19.8 trillion dollars, the GDP 25.5 trillion dollars, so the ratio was 78 percent. By comparison, in Germany the ratio of M1 money supply to GDP was 74 per cent in 2022.

If we assume that a similar ratio exists between the money supply and the total volume of 32 trillion dollars for the settlement of global trade and that the share of US dollars in the money supply required for this is 80 per cent, then the volume of Eurodollars in 2022 is likely to have been between 19 and 20 trillion US dollars. To simplify further calculations, a ratio between the money supply for global trade and the annual value of goods and services exchanged of 75 per cent is assumed below.

Calculating the loss of dollar value due to various scenarios of de-dollarisation

The World Trade Organisation estimates global trade in goods to increase by 1.7 per cent in 2023 and 3.2 per cent in 2024. Trade in services increased by 15 per cent in 2022 compared to 2021. Assuming the growth in trade in services continues at the same rate in 2023 and 2024, global trade in goods and services could increase to $33.5 trillion in 2023 and $35.5 trillion in 2024. The US foreign trade deficit could be one trillion dollars in both 2023 and 2024 without affecting the value of the dollar. Since this would be roughly equivalent to the additional amount of Eurodollars needed to settle the growing global trade - provided the dollar will continue to maintain its dominance as the reserve currency.

Assuming, however, that the BRICS countries, together with their currently known accession candidates, would no longer conduct their trade with each other in dollars from 2024 on, this would correspond to about ten percent of global trade according to the previous analyses - probably even more, since the economy in the BRICS countries is currently growing faster than in the established industrial nations. On the other hand, the latter export more services than the emerging countries. For the sake of simplicity, a share of ten percent is therefore assumed below.

Ten percent of a projected global trade volume of 35.5 trillion dollars corresponds to 3.5 trillion dollars. With a ratio of money supply to trade volume of 75 per cent and a previous share of the dollar in the money supply of 80 per cent, approximately 2.1 trillion fewer US dollars would then be needed to handle the corresponding exchange of goods and services.

On the other hand, if the forecasts are correct, world trade would grow by two trillion dollars between 2023 and 2024. With a ratio of money supply to trade volume of 75 per cent and a share of the dollar of 80 per cent, this would result in an additional amount of US dollars needed on the Eurodollar market of about 1.2 trillion. If we now subtract from this the amount of US dollars no longer needed for world trade due to de-dollarisation, the difference is -0.9 trillion dollars.

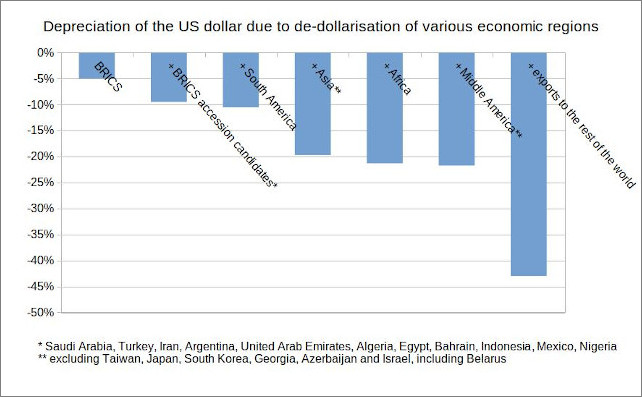

Thus, in 2024, a US foreign trade deficit of one trillion dollars would no longer be covered by the growth of global trade. In fact, the nearly two trillion dollars that would be too much on the market as a result of the US foreign trade deficit and de-dollarisation would reduce the value of the dollar by 10 per cent. The following figure shows the loss in value of the dollar in the course of the de-dollarisation of various economic regions.

Figure 5: Depreciation of the US dollar due to de-dollarisation of various economic regions, data source: own calculation based on UNCTAD and Fed data as well as estimates.

Domino effects

If the US dollar loses value because too much of it is in circulation in relation to the goods and services exchanged, US government bonds also become unattractive. What profit do annual interest rates of two to four percent bring if the dollar loses ten percent of its value in the same period? The mere abandonment of the dollar by the BRICS countries, including the accession candidates, in their bilateral trade is therefore capable of setting an avalanche rolling, at the end of which masses of US government bonds could be dumped, the credit rating of the US downgraded and the country no longer able to pay the higher interest rates if it incurs new debt - a fate that befell the Greeks, for example, in the early 2010s.

The threat to the US will even be greater when more countries turn their backs on the dollar, such as the South American and especially the Asian states. As analysed earlier, trade among these countries represents slightly more than 20 percent of world trade. Under the previous assumptions on the ratio of money supply to the volume of trade and the share of the dollar, the difference between the additional US dollars needed due to the growth of global trade and the effects of de-dollarisation would then no longer amount to -$0.9 trillion, but to -$3 trillion. If a US foreign trade deficit of one trillion dollars were added in 2024, there would be a total of four trillion dollars more on the Eurodollar market than would be needed for global trade. The dollar would thus suddenly lose 20 per cent of its value. A severe economic and financial crisis, very high inflation and a US national bankruptcy would then be inevitable.

About the author: Karsten Montag, born in 1968, studied mechanical engineering at the RWTH Aachen, philosophy, history and physics at the University of Cologne, and educational sciences in Hagen. For many years, he was an employee of a management consulting firm with close ties to the trade unions, and most recently department and project manager in a software company that produced and distributed an energy data management and billing system for energy trading.

Diskussion

0 Kommentare